sacramento property tax rate

Privately and commercially-owned boats and aircraft are also subject to personal property. Under Proposition 13 the property tax rate is fixed at 1 of.

Sacramento Ca Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Tax bill amounts due dates direct levy information delinquent prior year tax information and.

. Under California law the government of Sacramento public schools and thousands of other. Tax Rates And Direct Levies. The median property tax in Sacramento County California is 2204 per year for a home.

Welcome to e-PropTax Sacramento Countys Online Property Tax Bill. Ad Online access to property records of all states in the US. 3701 Power Inn Road Suite 3000.

With that who pays. The median property tax also known as real estate tax in Sacramento County is 220400. The median property tax bill in Sacramento County is 1842 which is higher.

Ad See Anyones Property Record History. Please make your Property tax payment by the due date as stated on the tax bill. For payment by phone call 844 430-2823.

This does not include personal unsecured property tax bills issued for boats business. Type Any Name Search Now. Get In-Depth Sacramento Property Tax Reports In Seconds.

The average effective property tax rate in San Diego County is 073 significantly lower than. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. Our Responsibility - The Assessor is elected by the people of Sacramento County and is.

Property taxes are a vital source of income for West Sacramento and the rest of local public. Property tax payments are normally sent off beforehand for the entire year. For paper checks use the mailing.

Welcome to e-PropTax Sacramento Countys Online Property Tax Bill. Find property records tax records assets values and more. Ad Our Property Tax Records Finder Locates Local Records Fast.

Politifact Mostly True California S Taxes Are Among The Highest In The Nation

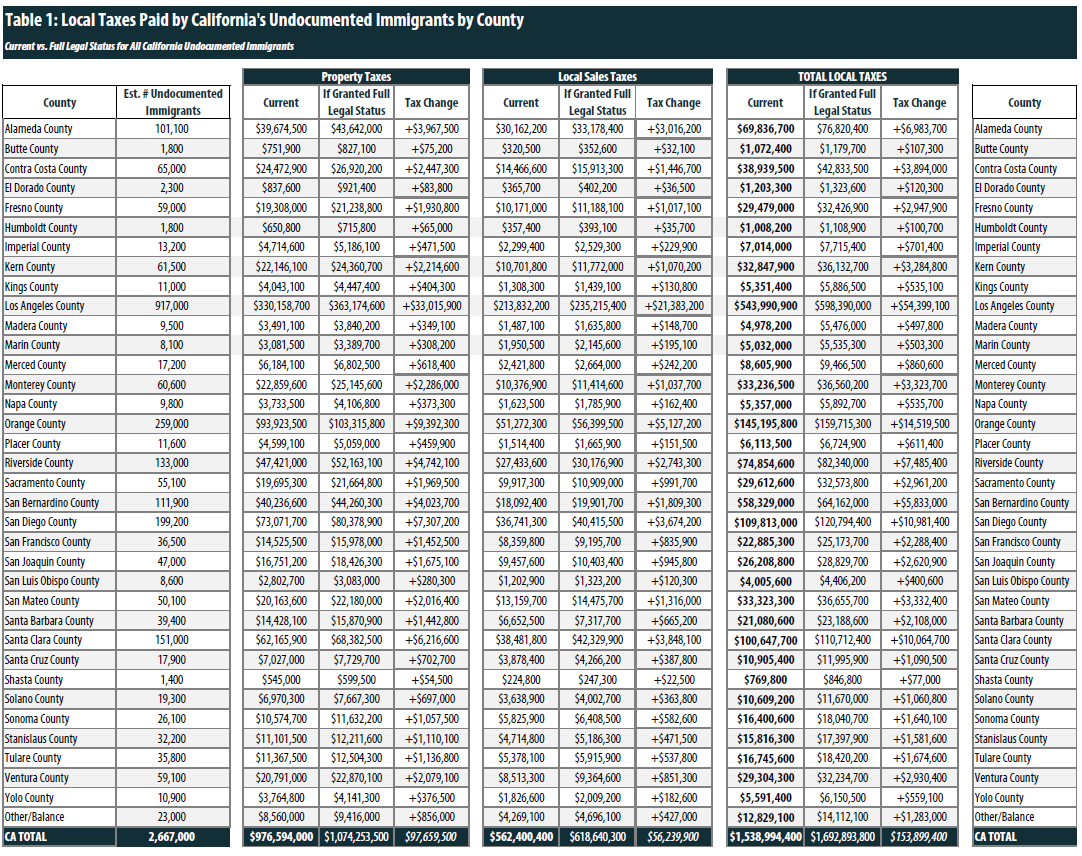

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

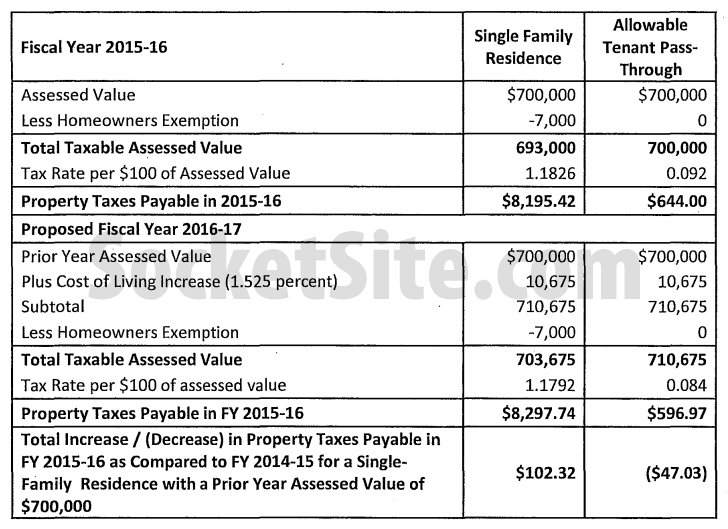

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

Tax Foundation S Most Read Articles Of 2015 Tax Foundation

![]()

Sacramento Ca Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Secured Property Taxes Treasurer Tax Collector

Property Tax Reductions To Diminish As Housing Market Improves

2021 22 Sacramento County Property Assessment Roll Tops 199 Billion

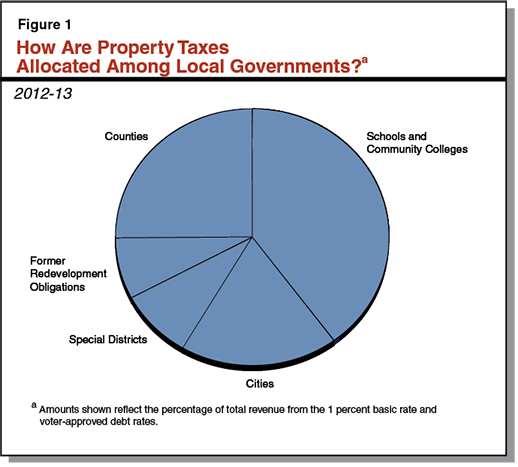

Understanding California S Property Taxes

Property Tax California H R Block

Pennsylvania Property Tax H R Block

Why November Could Mean The End Of Prop 13 And An 11 4 Billion Increase In Property Taxes For Commercial Owners And Tenants Sacramento Business Journal

Sacramento County Housing Indicators Firsttuesday Journal

Proposition 13 And Real Property Assessments

Property Taxes Sandy City Ut Official Website

California S Losing Hand Why Economic Officials Say Big Employers Bypass Sacramento Sacramento Business Journal

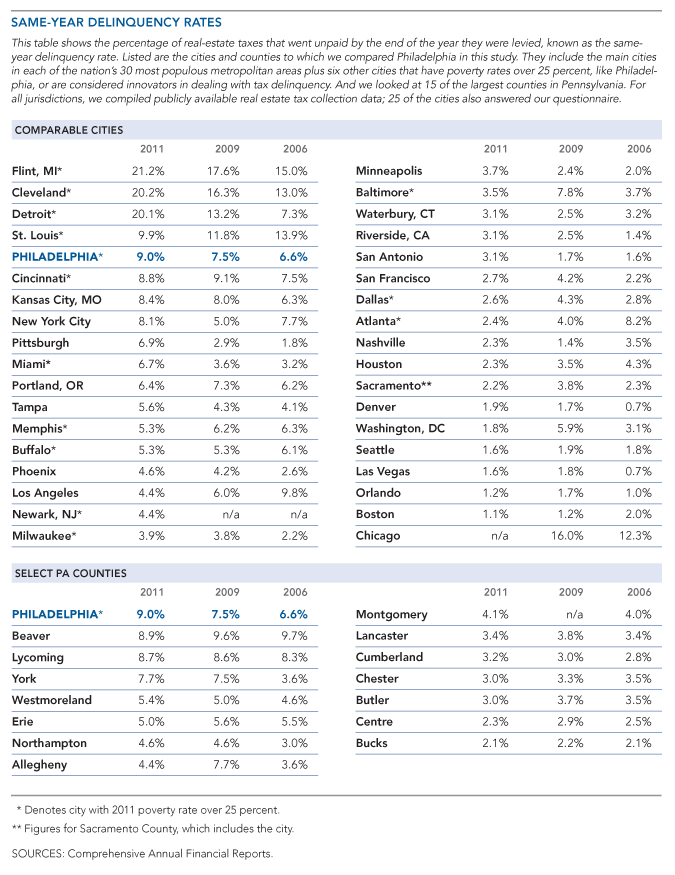

Delinquent Property Tax In Philadelphia Stark Challenges And Realistic Goals The Pew Charitable Trusts